Global Thermoplastic Polyurethanes Market Revenue to Record Stellar Growth Rate During 2005 – 2025

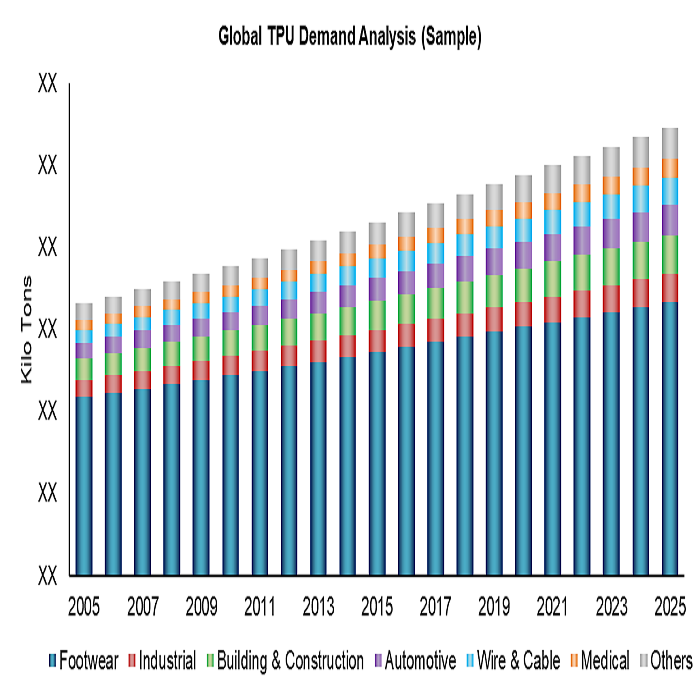

Thermoplastic Polyurethanes products. It is also used in small volumes in adhesives & sealants,aerospace and marine equipments. TPU offers exceptional benefits by bridging the gap between flexible rubber and rigid plastics. The biggest TPU market and application outlet is in the footwear & sporting goods industry, currently accounting for 40% of the global demand. In the footwear industry, TPU has seen rapid growth as the market has moved towards high performance sports shoes and more importantly as a result of increasing fashion trends for footwear with thicker soles. On account of its excellent durability and resistance, TPU is used in manufacturing of sporting goods such as in-line skates, surfboards, ski boots, goggles and others.

The global TPU demand in 2017 was estimated to be around 504 kilo tons and it is forecast to grow at a CAGR of 5.3% between 2017 and 2025 to reach 761 kilo tons in 2025. Asia-Pacific was the biggest market at global level in 2017 accounting for almost 61% of the demand on account of increase in footwear & sporting goods and improved automotive production. The primary driver for growth in demand of TPU in Asia-Pacific has been the migration of labor intensive downstream conversion industries,shifting of footwear production from developed high labor cost regions like North America and Western Europe, apart from burgeoning population growth and increasing living standards, both of which are driving growth in domestic demand for consumer goods also.

North America and Western Europe together account for around 30% of global TPU consumption. Asia-Pacific region will increase its market share to 68% by 2025 to reach around 520 kilo tons. North America and Western Europe are expected to slightly decline their current market share of 15% to around 12% each by 2025. In the long-term forecast till 2025, North America and Western Europe are estimated to witness average growth rates between 2%-3%. Central & Eastern Europe is estimated to grow at a CAGR of 3.8% while the Rest of the World which includes Central & South America and Middle East & Africa together is likely to witness high growth rate of around 5%, albeit on a lower volume base.

Asia-Pacific will see the strongest level of demand growth spurred on by China.The consumption of TPUs in China has been increasing, mainly because of increasing demand from its end-use industries like footwear manufacturing and sporting goods. Around 55% of China’s demand was from footwear & sporting goods applications including microcellular products. The country has the largest and most diverse manufacturing sector and still remains one of the attractive locations for manufacturing. The chemicals and petrochemicals industry along with the increasing expansions and industrialization will create opportunities for thermoplastic elastomers which in turn will create growth for footwear production. India is the largest global producer of footwear after China accounting for around 13% of global footwear production and the country is expected to witness a boom on account of favorable government policies,infrastructure improvements and technology up gradation.

In the European region, the biggest application for TPU is the industrial sector followed by the footwear & sporting goods.

Global TPU capacity amounted to over 830 kilotons by year-end 2017. There are currently 20 major producers of TPU operating more than 30 major plants globally. Historically the capacity utilization had witnessed a decline in 2008 – 2009 following onset of global economic recessionary trend. The TPU market will see new plant capacity being added in China (including new TPU compounders), and there will be a continued market shift to China and other Asian countries. Many projects are slated for China,several of which are being carried out by local producers; however, we anticipate some project delays and closures in China as well. With total additions of slightly over 250 kilo tons of new project by 2025, China’s market share in the global capacity will increase from current 48% to 57% by 2025.

TPU demand patterns are dramatically different between various regions and countries. In the areas with mature economies, demand growth for TPU is expected to fall well below global averages primarily due to the geographic shift of many manufacturing industries (such as the footwear & sporting goods, automotive and electrical & electronics industry) to areas of lower labor costs such as China and India. Overall, we forecast that demand for TPU will grow at an average rate of 5.3% per annum through 2025, above the 4.3%average post economic crisis.

FOR MORE REPORT :- https://prismaneconsulting.com/reports

GLOBAL THERMOPLASTIC POLYURETHANES Market Is Set to Boom in 2005 And Coming Years

Thermoplastic Polyurethanes (TPU) are used invarious end-uses such as footwear & sporting goods, automotive, building& construction, industrial products, wire & cable, and medical products. It is also used in small volumes in adhesives & sealants,aerospace and marine equipments. TPU offers exceptional benefits by bridging the gap between flexible rubber and rigid plastics. The biggest TPU market and application outlet is in the footwear & sporting goods industry, currently accounting for 40% of the global demand. In the footwear industry, TPU has seen rapid growth as the market has moved towards high performance sports shoes and more importantly as a result of increasing fashion trends for footwear with thicker soles. On account of its excellent durability and resistance, TPU is used in manufacturing of sporting goods such as in-line skates, surfboards, ski boots, goggles and others.

The global TPU demand in 2017 was estimated to be around 504 kilo tons and it is forecast to grow at a CAGR of 5.3% between 2017 and 2025 to reach 761 kilo tons in 2025. Asia-Pacific was the biggest market at global level in 2017 accounting for almost 61% of the demand on account of increase in footwear & sporting goods and improved automotive production. The primary driver for growth in demand of TPU in Asia-Pacific has been the migration of labor intensive downstream conversion industries,shifting of footwear production from developed high labor cost regions like North America and Western Europe, apart from burgeoning population growth and increasing living standards, both of which are driving growth in domestic demand for consumer goods also.

North America and Western Europe together account for around 30% of global TPU consumption. Asia-Pacific region will increase its market share to 68% by 2025 to reach around 520 kilo tons. North America and Western Europe are expected to slightly decline their current market share of 15% to around 12% each by 2025. In the long-term forecast till 2025, North America and Western Europe are estimated to witness average growth rates between 2%-3%. Central & Eastern Europe is estimated to grow at a CAGR of 3.8% while the Rest of the World which includes Central & South America and Middle East & Africa together is likely to witness high growth rate of around 5%, albeit on a lower volume base.

Asia-Pacific will see the strongest level of demand growth spurred on by China.The consumption of TPUs in China has been increasing, mainly because of increasing demand from its end-use industries like footwear manufacturing and sporting goods. Around 55% of China’s demand was from footwear & sporting goods applications including microcellular products. The country has the largest and most diverse manufacturing sector and still remains one of the attractive locations for manufacturing. The chemicals and petrochemicals industry along with the increasing expansions and industrialization will create opportunities for thermoplastic elastomers which in turn will create growth for footwear production. India is the largest global producer of footwear after China accounting for around 13% of global footwear production and the country is expected to witness a boom on account of favorable government policies,infrastructure improvements and technology up gradation.

In the European region, the biggest application for TPU is the industrial sector followed by the footwear & sporting goods.

For More Report :- https://prismaneconsulting.com/reports

Acrylamide monomer market to Show Exponential Growth as Demand for Curved Displays Increase

Acrylamide monomer market is produced by hydration of acrylonitrile (ACN). It is the raw material to produce polyacrylamide and is manufactured by more than 15 major producers. The biosynthetic route is the most widely used process for acrylamides commercial synthesis. It can also be synthesized by synthetic route. The bio-synthesis route has been preferred over the synthetic route due to its cost-efficiency. It uses immobilized nitrile hydratase biocatalyst while the synthetic route uses the costlier copper oxide catalyst. Polyacrylamide is the principal derivative of acrylamide accounting for 90% of its consumption. Any impact on polyacrylamide end-use applications market like water treatment, oil production and others will impact the global acrylamide demand.

The demand for acrylamide monomer market has been growing between 3% to 5% during the last few years and the global demand in 2018 was estimated to be around 1703 kilotons. About 45% of this demand comes in from water treatment applications while petroleum and paper & pulp together account for 45%. The remaining demand is mostly from other small volume applications like textiles and mineral processing. The water treatment applications are expected to witness the fastest growth during the forecast period followed by polyacrylamide applications in the petroleum industry to enhance oil recovery and in other petroleum production processes.

Historically, Asia-Pacific has been the largest demand region as well as the largest producer region and is likely to remain so even in the forecast period. The global acrylamide market is driven by Asia-Pacific, particularly due to strong demand for water treatment applications in China, followed by major demand in Japan and other developing Asian countries on the back of presence of large paper and pulp industries. The region accounts for about 57% of the global acrylamide consumption and China alone holds for 79% of total regional consumption. This (China’s consumption) translates to roughly 45% of the global demand. North America is second largest region accounting for 23% closely followed by Western Europe with a 17% share. Central & South America, Central & Eastern Europe, and Middle East & Africa together account for 3% of total global consumption.

Acrylamide production is concentrated majorly in three regions viz. North America, Western Europe, and Asia-Pacific. China is the largest producer of acrylamide, accounting for about 62% of the global acrylamide production mainly dominated by local producers. SNF, CNPC, and Kemira are the major players of acrylamide globally. SNF is the largest manufacturer of acrylamide with more than 5 production locations globally. New major capacities have been announced in China and most of these new upcoming capacities will be based on bio-synthetic routes. It is to be noted that most of the world-scale plants are located near to the end-use industries and this trend will continue for all new projects during the long-term forecast. The oversupply situation to an extent is more likely to offset with robust demand owing to stringent policies on water-treatment, increase in oil & gas production and restructuring in the major economies as they step-out of the looming financial slow-down. In the long term forecast to 2025, the global acrylamide market is expected to grow at an annual average of 3.6%.

For More Report:-https://prismaneconsulting.com/reports

Global Methyl Methacrylate Market to Witness Significant Revenue Growth Through 2025

Methyl Methacrylate Market (MMA) can be manufactured by various methods, the principal one being the cyanohydrin route. The manufacturing process of Methyl Methacrylate involves petrochemical as a feedstock, thus any fluctuations in the crude oil prices impact the Methyl Methacrylate market. MMAis a monomer usually used as a raw material for the production of several polymers. Majority of Methyl Methacrylate produced is polymerized into two categories namely homopolymers and copolymers. Around 75% of MMA is used as a raw material in the production of Polymethylmethacrylate (PMMA). Other applications include acrylic plastic & resins, surface coatings, impact modifiers,emulsion polymers, mineral based sheets, higher methacrylates, polyester modifiers and others. MMA market in China has been rising on account of rapid growth in Paints and Coatings segment. PMMA is the most commonly used polyacrylate and its increasing use in end use industries is accelerating the Methyl Methacrylate market. Other major driving factor for Methyl Methacrylate demand is a rise in demand for the lightweight automobiles in China. China is one ofthe major players in MMA production and accounts for around 726 kilotons of MMA capacity. Major manufacturers include CNPC group, Mitsubishi, Lucite and Evonik accounting for 89% of the total capacity. The MMA market in China is expected to grow at a CAGR of 4.7% during 2018-2025. Planned or unplanned shutdowns and crude oil prices skyrocketed the MMA price between $ 2700-3100 per tonne around the world in October. There has been a steep decline in crude oil price from Oct 2018 ($75/barrel) to Dec 2018 (Around $45/barrel) and has led to a decline in MMA production cost. This will facilitate the MMA manufacturers to provide the monomer at cheaper rates and further impact on the PMMA price.

For More Report :- https://prismaneconsulting.com/reports

THERMOPLASTIC VULCANIZATES MARKET Strategic Assessment Of Evolving Technology, Growth Analysis, Scope And Forecast To 2025

Thermoplastic Vulcanizates Market (TPVs) are mechanically compounded mixtures of a polyolefin (usually polypropylene)and an elastomer (specialty elastomers or EPDM) that is vulcanized during the process. TPVs are widely used to modify the properties of rigid thermoplastics, usually improving impact strength. Major applications of TPVs are in automotive, industrial, consumers, electrical, and hoses & tubing.

The global demand for TPV Market is anticipated to grow between 4-5% since 2005. The market witnessed a decline during the economic recession but bounced back to growth in 2010. As of 2017, North America constituted the largest regional market accounting for around 40% of the market. Asia-Pacific was the second-largest market followed by Western Europe.

The greatest growth potential for TPOs and TPVs in automotive uses will be in replacing PVC for many interior applications including instrument panel covers, armrests and steering wheels. Although TPVs are more expensive on a weight basis than EPDM or other thermoset rubbers, lower processing cost means that TPV products are cheaper. TPVs are also lighter requiring only one-third the amount that would be required of the EPDM blended. TPVs have good properties as weather seals in automotive applications.

The automotive industry is the largest TPV market at a global level. The market is likely to grow on account of continued use in the automotive industry for under the hood applications for passenger cars and trucks.

In addition to their ability to withstand minor impacts, Olefinic thermoplastic elastomers are used for automotive applications as a result of the cost,recyclability during fabrication, environmental image, low specific gravity, wide range of stiffness’s available, excellent outdoor weather ability and fade resistance, colorability and attractive impact performance over a wide temperature range. The shifting of automotive production from Western Europe to other low-cost regions in Asia has pushed regional demand, especially in China.

For More Report :- https://prismaneconsulting.com/reports

Germany PTFE Market 2005 | Business Analysis, Scope, Size, Overview, and Forecast 2017

Germany is the largest consumer of PTFE Market in Western Europe accounting for around 42% of the PTFE demand in the region owing to its vast automotive, electrical & electronics, chemical processing and other industrial & manufacturing sector. The country’s chemical industry is the biggest in the region and third largest in the world. Germany is also the major producer of chemicals, polymers, electrical & electronics in Europe. Electrical & electronics is Germany’s second largest industrial sector accounting for around 11% of total German industrial production, and about 3%of its gross domestic product (GDP). In terms of application, more than 40% of PTFE is utilized in chemical processing industry, 19% in mechanical industries,and 16% in electrical and electronics market. Demand for PTFE in Germany was estimated to be around 13.1 kilotons in 2017 which is met by Dyneon, the only major player in Germany with total capacity of 15.8 kilo tons. The demand is likely to reach 16.8 kilo tons in 2025 growing at CAGR of 3.2% per year. Germany exports to almost all other countries in the Europe. Italy, USA and France are the major export locations of Germany accounting for 45% of the total exports. Exports from Germany have been consistently high in comparison to its imports. Exports from the country range from 8 to 11 kilo tons between 2005 and 2017, except in 2009, where the exports fell to around 6 kilo tons. In the same period, Imports in Germany range from 5 kilo tons to 9.5 kilo tons with an average price of around $ 15.2/kg. For More Report :- https://prismaneconsulting.com/reports

CYCLIC OLEFINIC COPOLYMERS MARKET Study 2014: Impressive Development To Be Observed In Revenue And Growth Rate Across The Globe By 2025

Cyclic Olefinic Copolymers market (COCs) were commercially made available by the pilot-scale plant in Japan until Topas Advanced Polymers started large scale COC plant in Oberhausen, Germany. The plant capacity is estimated to be 30 Kilo Tons and global capacity of COC now is around 56-kilo tons. Cyclic Olefinic Copolymers are widely used in packaging, medical & healthcare, optical & optics, electronics, and others. COC has superior optical properties with high-temperature resistance and excellent moisture barrier characteristics. Major demand drivers are optical films and pharmaceutical packaging which has driven the COC market at a CAGR of 5% during 2015-2017. Other major COC manufacturing players are Zeon Corporation, Mitsui Chemicals and JSR Corporation with a combined capacity of 26 Kilo Tons as of 2017. The COC market price varies between 5-6 $/Kg and is expected to rise in the forecast period due to increasing demand. Zeon Corporation: 20 Kilo Tons Mitsui Chemicals: 3 Kilo Tons JSR Corporation: 3 Kilo Tons Image section COC Market by Major Applications Cyclic Olefin Copolymers (COCs) find application in the following: Packaging Medical & Healthcare Opticals & Optics Electronics Others Packaging COCs are most commonly used as modifiers in the manufacture of packaging films. Properties such as higher flexibility, moisture barrier, heat resistance and stiffness of polyethylene are enhanced when COC is added. Moisture barrier of COC is roughly twice and five times than that of HDPE and LDPE respectively. Its low cost in packaging has found numerous applications in food, healthcare, cosmetic, shrink films, labels, lamination, protective or bubble packaging and in forming films. COCs are highly used in pharmaceutical packaging. Medical & Healthcare The high moisture barrier, purity, clarity, and sterilization qualities of COC resin makes them an excellent replacement for glass and are ideally suited for pharmaceutical products. They are widely used in the production of syringes carrying insulin & other protein drugs, cartridges, and vials, as they increase the shell life and purity by being non-reactive to the medication, low weight and, are less brittle. Medicinal applications that require strong chemical resistance such as nicotine patches and pouches are also made by using COC. Other uses include diagnostic applications such as in cuvettes and micro plates due to their high UV transmission property. Optical & Optics Properties of COCs like shatter resistance, high heat resistance, low specific gravity, high transparency, and low water absorption makes them optimum in the use of printer lenses, CD & DVD pick up lenses, digital camera lenses, projector lenses, LED lenses, contact lenses, mobile phone lenses, light guide panels for LCDs, reflection films, automotive parts, and others. Electronics COCs are used in printed circuit boards (PCBs) and as an insulating material at high temperatures, excellent isotropic dielectric properties, thermo-mechanical property, electrical insulation, adhesion, low moisture uptake, and low stress. For More Report :- https://prismaneconsulting.com/reports

GLOBAL Superabsorbent Polymers Market , Incredible Possibilities and Industry Growth 2014-2025

The global Superabsorbent Polymers (SAP) market has shown moderate growth rates largely driven by rising demand from different end-use industries and from countries like in China, India and other Asia-Pacific countries (Specially South East Asia). Historically, the economically mature regions like North America and Western Europe have witnessed below average growth rates and will continue to lose their demand market share to Asia-Pacific countries like China and India. At the same time, Central & Eastern European demand is likely to grow at a higher rate of about 6.0% in the long term forecast albeit from a low base. The Central & South American region is forecast to grow at CAGR of around 5.8% till 2025; however, it will completely depend on how South American countries like Venezuela are able to cope up with the regional political uncertainties, inflation and other economic problems and the economic recovery of Brazil. The Middle Eastern & African markets, starting from a very small base, have seen the some of the highest growth rates, and are expected to grow at an annual average of 7.1% making the region witnessing some of the highest CAGR at a global level.

Global SAP demand was almost 2250.7 kilo tons in 2014 and it has grown by an average annual rate of slightly over 6.8% since 2014. The global SAP market is expected to grow at an annual average of around 5.7% during the forecast period till 2025.

SAP is primarily used in a number of hygienic and personal care products, such as baby diapers, adult incontinence products and sanitary napkins. Collectively, these uses make up approximately 94.9% of global SAP use. Amongst all these applications, the use of SAP in baby diapers is predominant. It accounts for around 80.7% of global SAP demand. The percentage of SAP use for disposable diapers is even higher in developed countries such as Japan, the US and Western European countries, and lower in countries that are still adopting disposable diapers. Diaper demand is also high in regions of higher population like China and India as well as developing regions like Brazil and Russia which show relatively low penetration by SAP, but may represent high potential for demand growth mainly due to higher disposable incomes, growing awareness of the need for good hygiene and an increasing number of working mothers.

The baby diapers sector is the fastest growing application representing about 80.7% of global SAP demand. Sanitary Napkins are the third largest sector, steadily growing with a roughly 5.8% share of global SAP demand. The second largest application is for Adult incontinence products that account for 8.3% share. The remaining SAP is used in agriculture, packaging materials, technical applications and other miscellaneous applications.

For More Report :- https://prismaneconsulting.com/reports

POLYPHENYLENE SULPHIDE MARKET to Witness Attractive Growth Opportunities in (Asia Pacific/ US)

Exceptional heat, chemical and fire resistant properties make Polyphenylene Sulphide Market a material of choice in automotive, aerospace and coal fired power plant industries. Polyphenylene Sulphide manufacturers are concentrated majorly in Japan and U.S. while China is expected to remain the largest consumer in long term forecast.

As against production capacity rise of PPS Market by 265%, the demand has increased by 126% between 2005 and 2017. This suggests an unprecedented acceptance of PPS as an engineering plastic in automotive,electrical & electronics, aerospace and filter media applications.

Polyphenylene sulfide is a high temperature engineering plastic.It is best known for its light weight ability, high temperature resistance,chemical resistance, mechanical strength, abrasion resistance, high dimensional stability. PPS has both thermal degradability and chemical reactivity. Globally the PPS market is witnessing growth on account of increasing applications and growing demand in Asia-Pacific and other developing regions. It serves end-use industries such as Automotive, Industrial, Filter Media, Electrical & Electronics, Aerospace and Others. Most of the Polyphenylene sulfide resin manufacturers are in Japan, South Korea, United States and China.

For More Report :- https://prismaneconsulting.com/reports

BUTADIENE MARKET to Show Exponential Growth as Demand for Curved Displays Increase.

At a global level, the butadiene demand has grown lower than the world GDP growth. Butadiene Market is not very closely related to GDP growth like that of commodity polymers that are directly correlated to economic growth. Most of the butadiene is produced a by-product/ co-product and various other factors including the production of ethylene and demand from other end-use industries cause a change in butadiene trade dynamics.

Crude C4 supply patterns are somewhat different between various regions and countries. In Asia, and Europe naphtha is the most common feedstock while in North America, steam cracker feed slates can vary depending on relative production economics.

Over 95 percent of the butadiene is produced as a byproduct of ethylene production from steam crackers and recovered via extractive distillation. In certain parts of the world, there are still some production units based on on-purpose routes and this is expected to grow in the long-term forecast.

The supply of mixed C4s and butadiene is not driven by its consumption but also the consumption and production of Olefins as butadiene is mostly a co-product. Historically the butadiene market was either oversupplied or undersupplied. The market has never been balanced. During a situation of the deficit, butadiene is mostly extracted from the C4s produced by the steam cracker while during ample supply, producers use different mechanisms for processing C4s with associated values without producing Butadiene. This trend of not so balanced market will continue in the forecast period through the market will approach a nearly balanced scenario.

As most of the global butadiene is produced by extracting it from crude C4s which are produced as result of cracking heavy feedstock such as naphtha. As the crackers are shifting towards lighter feedstocks it is believed that the butadiene production from ethylene co-productions will become insufficient which will led to an increase in on-purpose butadiene production. This will most likely push the butadiene prices upwards as more on-purpose butadiene capacities come on-stream.

In the last 5 years, On account of the shale gas advantage, the crackers in the US have switched to lighter natural gas-based feedstocks leading to a decline in C4 production. In China, new on-purpose butadiene production through the oxy-dehydrogenation process is likely to come upon a commercial scale. Hence during the forecast period, on-purpose technologies are expected to be important though its economics are higher in the current scenario.

The global automotive industry has fully recovered from the economic recession of 2008 -2009 and the sales and profit have been higher than the pre-crisis level right from 2012 onwards. The major drivers of the butadiene industry include an increase in the automotive and tire industry.

There has been a shift of the automotive industries and market from Western Europe and the USA to Asia-Pacific.

China, India and South Korea are expected to witness strong growth in the automotive sector which will drive the demand for butadiene derivatives.

Strong automotive sales in North America and Asia-Pacific countries like China and along with increased demand for electric vehicles are expected to be key demand drivers for butadiene derivatives.

In 2018, SBR applications constituted the largest demand for butadiene accounting for nearly 29% of the total demand followed by PBR accounting for around 24% of the total demand. ABS end-use together accounted for about 15.7%. All other applications including adiponitrile, nitrile & polychloroprene elastomers and others constituted between 5% to 8% each of the total demand.

For More Report :- https://prismaneconsulting.com/reports

Adipic Acid Market Forthcoming Developments, Growth Challenges, Opportunities 2025

More than 50% of Adipic acid Market is globally consumed for the production of Polyamide 6, 6. The shift of exports can be seen in the adipic acid market where China is leading the export market due to several capacity additions in the last 10 years. China started a significant export of adipic acid in 2010 and became a net exporter in 2012. The exports have increased from 31-kilo tons in 2010 to around 320-kilo tons in 2017. This demographic shift of export has also led to some capacity rationalization in the U.S where In vista closed its adipic acid plant situated at Orange, Texas in 2015.

The Asia Pacific leads the consumption of adipic acid accounting for 44% of the world consumption followed by Western Europe and North America with 26% and 23% respectively. Other regions account for just over 7% of global consumption.

The main use of Adipic acid is for Nylon 6, 6 resins and fibers with the much lesser amount going into polyester polyols used in polyurethanes and into adipic acid esters, to be used as specialty plasticizers. Nylon 6, 6 yarns are used in non-staining carpets, home furnishing, apparel, and tire cord. Other fibers uses are in finishing lines, brush bristles, parachutes, and backpacks. Nylon 6, 6 accounts for the largest share for adipic acid and it is expected to continue to remain in the long-term forecast. Globally, higher production of industrial & textile fibers and carpet is likely to push the demand for adipic acid. Improvement in the global automotive production and housing market along with consumer spending is further likely to push the demand northwards in the short and mid-term forecast.

The global adipic acid market is forecast to grow between 2% to 2.5% in the long-term forecast till 2025 as demand from Asian countries especially China where it is estimated to grow in line with the GDP growth in the short and long-term forecast.

FOR MORE REPORT :- https://prismaneconsulting.com/reports

GLOBAL POLYACETAL MARKET, Incredible Possibilities and Industry Growth 2005-2025

The Global POM Market Demand in 2017 was estimated to be about 1276 kilotons which have grown by at an aggregate rate of 4.5% per annum between 2005 and2017. Global demand is expected to grow to nearly 1693 kilotons by 2025, with a growth rate of 3.6%

Utilization rates for POM globally averaged nearly at about 73%between 2005 and 2017. The utilization rates peaked to 87% in 2007 before declining to 71% in 2009 mainly due to a decline in demand as well as a result of new production capacities coming on-stream. In our short term forecast to 2020, we expect utilization rates to remain around low 70s.

- Top eleven producers hold about 70% of the global production capacity and with at least fifteen other companies producing smaller quantities.

- The largest producers are of POM copolymers while only two plants produce POM homopolymer.

- Five of the largest eleven POM producers have production facilities in the USA, Western Europe, and Asia.

FOR MORE REPORT :- https://prismaneconsulting.com/reports

FLUOROSILICONE ELASTOMERS MARKET Study 2010: Impressive Development To Be Observed In Revenue And Growth Rate Across The Globe By 2025

The global demand for fluorosilicone elastomers (FVMQ) market was about 3,423 tons in 2014 and the market is forecast to grow at a CAGR of 5% in the long-term forecast till 2025. The global average operating rates were estimated to be around 56%. The fluorosilicone elastomers demand is estimated to reach 5049 tons by 2025 owing to the growth in automotive as a result of car build and partly increase use of fluorosilicone elastomer for better efficiency. Developments in the aerospace and industrial sector are also expected to add to the growth.

In 2010, North America, Western Europe and Asia-Pacific, accounted for 30%, 26% and 39% of global consumption of fluorosilicone elastomers (FVMQ). There are only 3 major players and the largest capacity is North America. Demand growth in developing economies like Asia-Pacific is projected to grow at an average of 7.4%. Central & Eastern Europe is forecast to grow at CAGR of 4.1%, albeit from a small base. There has been some overcapacity globally, the average operating rates are expected to improve in the long-term forecast.

The global FVMQ demand is estimated to have been 3,423 tons. Strong automotive sales in North America and Asia-Pacific countries like China and India along-with demand from the industrial application is expected to drive the global demand growing at an annual average of 5%.

Automotive application will continue to dominate the FVMQ end-use followed by aerospace. In 2017, automotive applications accounted for 57% of the total demand followed by aerospace and Industrial at 16% and 12%, respectively. The third biggest end-use of FVMQ is of industrial applications; however, it accounts for a small volume in comparison to automotive and aerospace. Other trends to gradually reduce the weight to achieve fuel efficiency and stringent emission laws would favour the growth of FVMQ.

FOR MORE REPORT :- https://prismaneconsulting.com/reports

HIGHER LINEAR ALPHA OLEFINS MARKET 2014-Business Analysis, Scope, Size, Overview, and Forecast 2025

In 2017, the demand for Higher Linear Alpha Olefins Market in Asia Pacific was estimated to be 129.7 kilo tons. The region is likely to witness demand growth at a rate of 3.1% in the long term forecast till 2025. In terms of applications, Linear Alkyl Benzene (LAB) which is considered under detergent intermediates account for the largest share roughly estimated at 27.2%. The second biggest end-use of higher LAOs was for Polyalphaolefins (PAO) application roughly accounting for 20%. This was followed by surfactants & intermediates and lubricants together accounting for more than 24%. Oxo alcohols accounted for around 10% of the total demand while all other applications including plasticizer, oilfiled chemicals, paper sizing chemicals together accounted for a share of 18%.

Amongst the Higher LAOs, demand for Decene-1 accounted for almost 27% followed by dodecene-1 at 23%. Tetradecene was the third largest type of Higher LAO with a share of around 17%. All other LAOs from C16 & other Higher LAOs together account for 33%. Decene-1 is expected to grow at 3.4% while all other higher LAOs (dodecene-1, Tetradecene-1 and C16 & other Higher LAOs) are expected to grow at an average of around 3.0%.

For More Reports :- https://prismaneconsulting.com/reports

GLOBAL LINEAR ALPHA OLEFINS Market 2010 Share and Growth Opportunity : Type, Application, Companies and more

Linear Alpha Olefin Market in Asia Pacific region has seen above-average growth in the last five years due to increasing demand for polyethylene and other plastic materials in major economies like China and India. The Butene-1 demand in the Asia-Pacific region in 2017 was estimated to be around550 kilo tons. It is forecast to grow at a CAGR of 8.0% between 2018 and 2025to reach 1011.7-kilo tons in 2025. The growth can be attributed to the increase in polyethylene demand in the region for major applications including packaging, films and construction & infrastructure applications like piping. Butene-1 demand for polyethylene co-monomers is likely to increase its market share from around 86% in 2017 to around 88% by 2025 while all other miscellaneous applications such as valeraldehyde and 1, 2-butylene oxide and polybutene-1 together are expected to witness a small decrease in the market share. This is owing to increased use of butene-1 in polyethylene production to meet the demand for polyethylene in countries like China, India and for exports to the other regions of the world.

In terms of Butene-1 consumption, China is expected to grow at 10.5% during the forecast period due to strong growth in its polyethylene applications.In Asia Pacific, the polyethylene application accounts for more than 86% of making it one of the major applications of Butene-1 on account of the strong demand from LLDPE and HDPE end-use applications and rising middle class, and increase in disposable income in China, India, Indonesia and other developing economies. China has a strong petrochemicals industry with a lot of focus on research and development activities and a lot of new polyethylene, polypropylene and other chemical capacities were added in 2009 – 2014. China further plans to add new swingHDPE/ LLDPE and dedicated HDPE polymers capacities during the forecast period. India has also invested in polyethylene plants in the country and it is now a net exporter of polyethylene. There is one capacity planned by LongsonPetrochemical Company in Vietnam and other mid-sized polyethylene plants in Thailand as well. This can prove to be a driving force for butene-1 demand in the Asia Pacific region.

China is the biggest market for butene-1in the region in 2017 with a consumption of almost 226 kilo tons accounting for almost 41% of the regional demand. It has benefited owing to huge demand for polyethylene to meet it infrastructure and construction needs. South Korea isthe second biggest market and the total demand was estimated to be 72.1 kilotons accounting for share of 13.1% and estimated to grow at a CAGR of 2.3% on account of increase in consumption of LLDPE in the region. India’s butene-1consumption in 2017 has been estimated at 63.3 kilo tons followed by Thailand 61.1 kilo tons. All of other countries like Vietnam, Malaysia, Thailand, Singapore and other Rest of Asia-Pacific individually consume between 10 kilo tons to 25kilo tons each. China and India will see the strongest level of demand growth spurred on by new investments for polyethylene plants and increasing manufacturing sector. Both the countries have one of the largest and most diverse plastics manufacturing sectors and still remain the attractive location for manufacturing.

The Asia-Pacific Butene-1 in terms of value was estimated to be around USD 467.7 million while the higher LAO market was valued at USD 149.6 million. The Asia-Pacific region is expected to be one of the largest market in the long-term forecast owing to strong plastics and polymers industry and fast-growing market in major Asian countries like China, Japan, India, South Korea, and other Asia-Pacific countries. The regional Butene-1 market is projected to reach USD 895.3 million by 2025, at a CAGR of almost 8.5%. Increasing demand for Polyethylene applications especially LDPE and some demand from HDPE are expected to fuel the demand for butene-1.

In terms of value, the biggest market in Asia-Pacific for butene-1 is China followed by South Korea. The Asia-Pacific Butene-1 market was valued at USD467.7 million. The third biggest market was India estimated at USD 53.8million. The Higher LAOs value market was around USD 149.6 million in 2017 and it is expected to grow at a CAGR of 3.7% during the forecast period to reach USD 199.2 million.

For More Report:-https://prismaneconsulting.com/reports

Global Maleic ANHYDRIED Market to Witness Significant Revenue Growth Through 2025

The global Maleic Anhydride (MAN) market has shown moderate growth rates largely driven by rising demand from different end-use industries and from countries like in China, India and other Asia-Pacific countries (especially South East Asia). Historically, the economically mature regions like North America and Western Europe have witnessed below-average growth rates and will continue to lose their demand market share to Asia-Pacific countries like China and India. At the same time, Central &Eastern European demand likely to grow at a higher rate of about 4.4% in the long term forecast albeit from a low base. The Central & South American region is forecast to grow at CAGR of around 3.5% till 2025; however, it will completely depend on how South American countries like Venezuela are able to cope up with the regional political uncertainties, inflation, and other economic problems and the economic recovery of Brazil. The Middle Eastern &African markets, starting from a very small base, have seen the highest growth rates, and are expected to grow at an annual average of 7.0% making the region witnessing some of the highest CAGR at a global level.

The average historical utilization rates of Maleic Anhydride together have been in the range of 56.2% from 2014 to 2018. On an average 144 kilo tons of capacities have been added annually to meet the global Maleic Anhydride (MAN) demand. During 2014 – 2018, around 530 kilo tons of capacities have been added in Asia-Pacific countries of which 495 kilo tons was alone added in China. The other region that added a new Maleic Anhydride plant was the Middle East region where around 45 kilo tons of MAN capacity was added in 2018. Further additions are most likely to occur in Iran and Russia. Some speculatives can also be added in Asian countries like India as a measure to decrease import dependency. Overall, the MAN capacity is estimated to be around 3852.5 kilo tons by 2022 and an estimate 3862.5 kilo tons by 2025. The USA and the Middle East has the advantage of low-cost feed stock while in China it is the move towards minimizing the export dependency by increasing operating rates and also on account of a lower cost of production from coal. Historically, the USA has seen a growth in the petrochemicals industry due to shale gas reserves.

At a global level, Maleic Anhydride market has witnessed significant changes. With the emergence of new regions and the increase in exports, the new regions like the Middle East & Africa are playing key roles. The traditionally dominant markets are experiencing slow growth in terms of both demand and production. Countries like China are expected to drive the regional as well as global Maleic Anhydride (MAN) market. This is expected to make China the key market with some major changes expected in the trade pattern.

For More Report:-https://prismaneconsulting.com/reports